[ad_1]

Something strange is occurring in the market place for copper that hasn’t been noticed in nearly 30 years. Some see it as however a further indicator that the worldwide financial system could be headed for a tough patch.

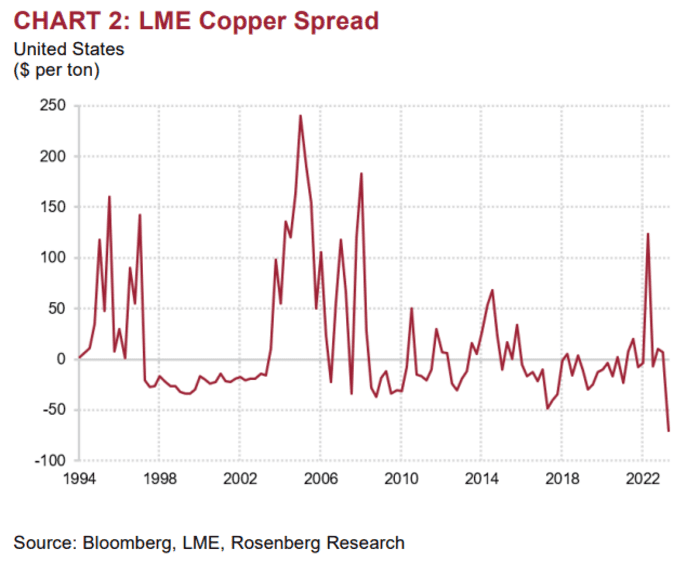

Declining rates in the location industry for copper have pushed the distribute among the spot cost and the price tag of futures traded on the London Metals Trade for supply a few months out to its widest level considering the fact that 1994, putting the copper futures curve into a state of excessive contango — a term utilized by commodity futures traders to describe when futures rates are trading in extra of the spot selling price.

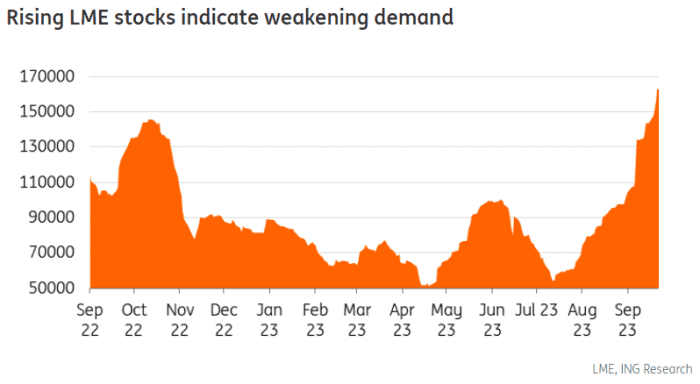

Price ranges have been declining more than the earlier few months as inventories have piled up at London Metals Trade warehouses about the entire world.

Slipping desire is mainly a factor of weak point in the Chinese economic climate, analysts say. But provided that China’s economy is the world’s 2nd largest, the ripple results could be felt as significantly away as Europe, the U.S. and outside of.

ROSENBERG Investigation

According to the newest details from LME, 163,900 tonnes of copper are being stored in trade warehouses about the earth as of Sept. 22. That’s an enhance of 50% due to the fact the get started of September, adhering to a 50% boost during the thirty day period of August. Inventories have been climbing since mid-July, details clearly show.

ING

The implication is obvious, commodity analysts say.

“This displays apparent signals of weakening demand,” stated Ewa Manthey, a London-dependent commodity strategist at ING, in a notice to clients. To be confident, Manthey noted that inventories continue to be minimal by historic requirements.

Dave Rosenberg, a previous Merrill Lynch economist who is now operates Rosenberg Exploration, also blamed weakening financial disorders in China for the slump in copper charges.

He also famous that costs could be reacting to a decrease in worldwide trade.

Trade fell 3.2% on a calendar year-more than-12 months basis in August, the steepest fall considering that August 2020, in accordance to the hottest figures from the World Trade Check, which is revealed by the Netherlands Bureau for Financial Policy Examination.

Usually, declining trade exercise is a sign of declining economic action more broadly.

For several years, copper has enjoyed the sobriquet “Dr. Copper,” supposedly for its capability to sniff out world financial developments just before they are reflected in the formal info. Copper has a variety of uses in industrial and medical products and solutions, to the electric powered wiring in homes, along with roofing, plumbing and beyond. It is a person of the most frequently utilized industrial metals.

But some analysts have not long ago questioned copper’s predictive likely. Bank of America’s commodity investigate team led by Michael Widmer and Francisco Blanch stated copper’s sensitivity to GDP progress has waned in a research notice printed final month.

“As a cyclical asset, copper demand has generally been intently correlated with international GDP development, but that sensitivity has been declining,” the Bank of The us staff explained. “This lessened beta to GDP has already presented assistance to copper rates at all over $8,500/t ($3.86/lb) in recent quarters and limited downside price pressures on the crimson metallic in the midst of an industrial recession, a scarce prevalence,” they add.

Copper selling prices for December shipping and delivery

HG00,

HGZ23,

trading on the New York Mercantile Trade, which competes with LME, were off .7% at $3.65 a pound on Tuesday, hovering about their cheapest level because late May possibly, according to FactSet facts.

[ad_2]

Supply link