[ad_1]

Commercial true estate that appears “significantly overvalued” could tumble in price tag, as credit card debt fees rise and loan providers occur under force, the Worldwide Monetary Fund warned on Tuesday.

Commercial authentic estate has started to deal with sizeable pressures as world-wide central banking institutions tightened their financial policy stance, the IMF claimed in its most recent international monetary security report.

In the U.S., banking companies have been tightening lending standards, earning it harder for landlords to protected funding, when funds that also lend in the business authentic estate sector are retrenching, the report reported.

Stress in authentic-estate expenditure trusts (REITs) and in the business property finance loan-backed securities (CMBS) sector, both significant resources of financial loans to landlords, also could incorporate to the sector’s woes, the report mentioned.

This could “exacerbate adverse shocks if the financial system slows substantially,” in accordance to the IMF, which warned of mounting defaults and losses at loan companies from slipping property values and illiquid marketplaces.

More compact U.S. banking companies in target

The IMF claimed, “a ten years of incredibly reduced fascination rates boosted values in the operate-up to the pandemic in 2020 beyond what was stated by essential aspects.”

As a consequence, the agency sees dangers of a “broader correction” in professional real-estate values, even following U.S. listed REITs already fell just about 14% in value in the to start with quarter of 2023 from a calendar year ago.

The IMF on Tuesday also projected the weakest world wide financial development in a lot more than 30 several years.

U.S. Treasury Secretary Janet Yellen signaled a much more upbeat tone while, declaring Tuesday that it was critical not to overdo the negativism in the outlook for the world overall economy, ahead of an yearly IMF-Planet Lender summit.

Nonetheless, the collapse of Silicon Valley financial institution in March set a emphasis on the balance of more compact U.S. banking institutions, with considerably less than $250 billion in overall belongings, which account for a few-quarters of all industrial true estate lending. Any “deterioration in asset top quality would have important repercussions both equally for their profitability and lending urge for food,” the IMF steadiness report reported.

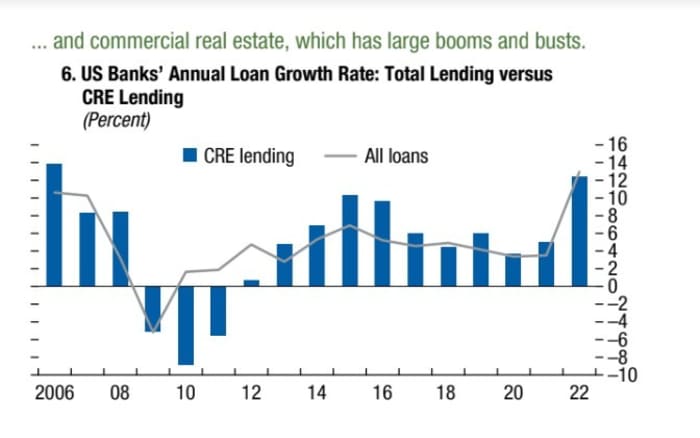

Commercial real estate has been susceptible to previous booms and busts. Previous yr, commercial actual-estate mortgage volumes touched a approximately 12% yearly amount at U.S. financial institutions, as a portion of their whole lending activity, or the best considering that 2006 (see chart).

Industrial true estate tends to see big booms, busts

IMF Economical Steadiness Report, Bloomberg Finance, countrywide central banking institutions

Industrial-true estate bust?

Torsten Slok, chief economist at Apollo World-wide Management, approximated that a pullback in industrial serious estate building could final result in a drag of all around .75% to U.S. gross domestic merchandise above the coming 3 a long time.

“In other terms, with the industrial real estate bubble bursting, we are probable to enter three years with reduced development, equivalent to what we observed following the housing bubble burst in 2008,” Slok explained in a Tuesday customer be aware.

He also expects the Federal Reserve to interest reduce costs later on this year, and to hold them minimal for a number of decades, even though also resuming massive-scale asset purchases, or quantitative easing, in 2024.

U.S. stocks had been primarily higher on Tuesday, with the Dow Jones Industrial Typical

DJIA,

up 150 factors, or .5%, at very last verify, and the S&P 500 index

SPX,

up .2%, in accordance to FactSet.

[ad_2]

Source link