[ad_1]

August was a scorching month and it was not just about the weather conditions. Money markets are now bracing for what is possible to be a rebound in headline U.S. inflation following 7 days, fueled by greater strength prices.

Barclays

BARC,

and BofA Securities

BAC,

hope August’s shopper cost index to replicate a .6% regular monthly rise, up from the .2% regular readings viewed in July and in June. In addition, they set the annual CPI inflation price at 3.6% or 3.7% for very last month, which compares with the 3.2% and 3% figures described respectively for the prior two months.

Although Federal Reserve policy makers and analysts are loath to browse as well significantly into one particular report, August’s CPI has the potential to disrupt anticipations that having back to the central bank’s 2% focus on will be uncomplicated. Inflation has rather been nudging back up given that June, with the very likely rebound in August getting regarded as largely pushed by the electrical power sector. What now stays to be noticed is how considerably for a longer period electrical power price ranges will remain elevated and no matter whether they’ll begin to feed into narrower measures of inflation that make a difference most to the Fed.

Browse: Stock-current market buyers just received reminded that the inflation battle isn’t in excess of

“We’re likely to see a spike in gas charges and other commodity price ranges pushed by provide cuts, which suggests headline CPI goes back again up,” explained Alex Pelle, a U.S. economist for Mizuho Securities in New York. Via cellphone on Friday, Pelle reported that prospective clients for a hotter August CPI report have already been factored in by economical marketplaces, with all three key U.S. stock indexes heading for weekly losses.

How investors respond to next Wednesday’s info will probable occur down to no matter if the rebound in headline figures is viewed as “a 1-off” or a little something that will get repeated, and “what that usually means for the bottoming off of inflation,” Pelle explained. “The fairness sector is heading to have some trouble in the fourth quarter just after a fairly extraordinary first 50 %. Earnings anticipations are even now really substantial, but the macro-pushed backdrop is challenging.”

Climbing energy charges in August have now spilled into the month of September, with gasoline achieving the optimum seasonal amount in extra than a decade this 7 days. Voluntary manufacturing cuts by Saudi Arabia and Russia are a big contributing component curtailing the source of crude oil into yr-conclusion, and Goldman Sachs has warned that oil could climb above $100 a barrel.

In economical marketplaces, there is a single team of traders which is telegraphing that the ultimate mile of the road toward 2% inflation will not be easy.

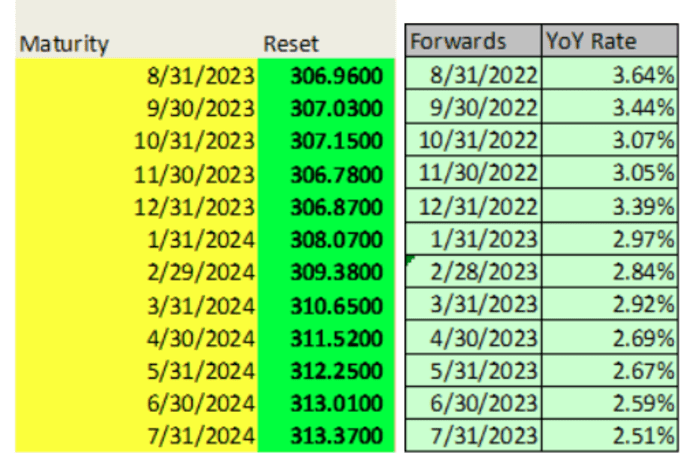

Traders of derivatives-like devices recognized as fixings anticipate that the subsequent 5 CPI stories, like August’s, will produce once-a-year headline inflation fees previously mentioned 3%. While plan makers care more about core readings that strip out unstable meals and energy selling prices, they’re informed of how substantially headline figures can impact the public’s expectations.

Source: Bloomberg. The maturity column displays the month and 12 months of upcoming CPI stories. The forwards column reflects the year-in the past period of time from which the yr-in excess of-calendar year fee is centered.

At BofA Securities, U.S. economist Stephen Juneau explained August’s CPI will not essentially alter his firm’s check out that inflation is most likely to go decrease up coming calendar year and tumble again to the Fed’s target devoid of the want for a recession. BofA Securities expects just a single more Fed level hike in November and will retain that check out if August’s CPI report arrives in as he expects, Juneau mentioned by way of cellphone.

Just after stripping out risky food items and power goods, BofA Securities, together with Barclays, expects August’s core CPI readings to appear in at .2% month-in excess of-thirty day period — matching June and July’s degrees — and to tumble to 4.3% on an once-a-year foundation.

Primarily based on core actions, August’s report wouldn’t “change the narrative all that significantly: Everything factors to a moderation in value progress,” Pelle reported. “There’s a motive why foods and energy are ordinarily excluded,” and “we really don’t want to put too substantially inventory into one particular month.”

As of Friday afternoon, all 3 significant U.S. inventory indexes have been headed greater, with the S&P 500 making an attempt to snap a 3-working day dropping streak. Dow industrials

DJIA,

the S&P 500

SPX

and Nasdaq Composite

COMP

had been respectively on monitor for weekly losses of .8%, 1.2%, and 1.8%. They’re however up for the year by a lot more than 4%, 16% and 31%.

In the meantime, Treasury yields turned had been tiny altered on Friday as fed money futures traders priced in a 93% prospect of no motion by the Fed at its following policy assembly in significantly less than two weeks, and a much more-than-50% likelihood of the exact same for November and December — which would depart the Fed’s primary policy rate goal among 5.25%-5.5%.

“There is a chance that buyers are way too complacent about the inflation report,” said Brian Jacobsen, main economist at Annex Wealth Management in Elm Grove, Wis. “We may not get to 2% inflation as quickly as several hope.”

[ad_2]

Resource website link