[ad_1]

U.S. inventory futures had been a tad firmer on Monday as traders welcomed waning signals of banking sector worry.

How are stock-index futures investing

-

S&P 500 futures

ES00,

+.40%

rose 8 details, or .2%, to 4009 -

Dow Jones Industrial Common futures

YM00,

+.38%

included 70 details, or .2%, to 32504 -

Nasdaq 100 futures

NQ00,

+.21%

climbed 7 points, or .1%, to 12897

On Friday, the Dow Jones Industrial Common

DJIA,

rose 132 details, or .41%, to 32238, the S&P 500

SPX,

enhanced 22 details, or .56%, to 3971, and the Nasdaq Composite

COMP,

acquired 37 points, or .31%, to 11824.

What’s driving markets

Inventory futures were firmer as buyers welcomed signs that recent stress surrounding the banking sector is waning.

Europe’s Stoxx 600 Financial institutions index was up 2% as Deutsche Lender

DBK,

supply of Friday’s problems, rebounded 5%.

Information that To start with Citizens

FCNCA,

has agreed to invest in the deposits and loans of unsuccessful Silicon Valley Financial institution also is aiding underpin sentiment.

“With Silicon Valley Bank’s deposits and financial loans now housed in extended expression lodging in the U.S., a relaxed of kinds has descended on the banking sector…Shunting components of the failed lender off to a new owner may perhaps give the regulator a lot more capability to deal with problems nevertheless threatening to pop up somewhere else, especially with U.S. regional financial institutions,” mentioned Susannah Streeter, head of cash and marketplaces at Hargreaves Lansdown.

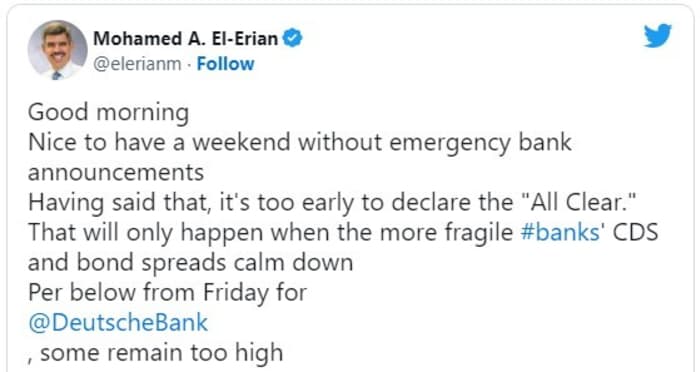

Mohamed El-Erian, adviser to Allianz and Gramercy, welcomed the calmer temper, but noted that fundamental uncertainty may perhaps linger unless of course signals of worry in the current market for insuring ban debt, known as credit history default swaps, dissipated additional.

U.S equities have been specially choppy in modern months as traders have expressed anxiety about banking sector anxiety although welcoming the lower bond yields those people concerns have delivered.

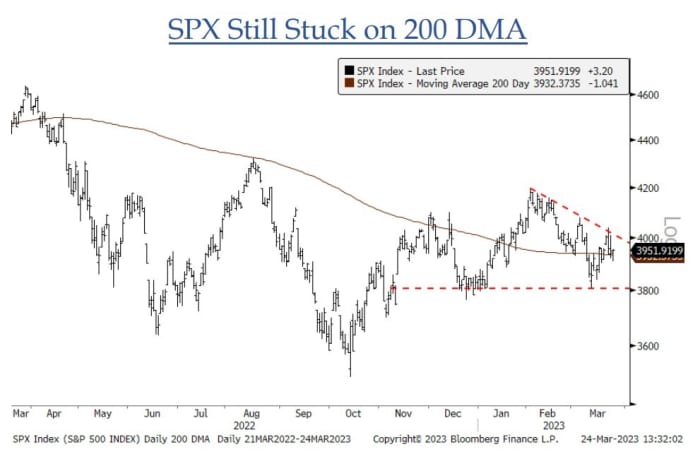

This has remaining the S&P 500 caught in close proximity to the middle of the 3800-4200 variety it has held for four months, and leaves the Wall Avenue barometer “stuck on either side of its 200-working day shifting average”, notes Jonathan Krinsky, chief complex strategist at BTIG.

Supply BTIG.

There are no notable U.S. economic updates established for launch on Monday, but there will be some Fed-converse when Governor Philip Jefferson is due to provide reviews at 5 p.m. Jap.

[ad_2]

Source hyperlink