[ad_1]

A trio of lender collapses very last month put some economists and investors on the warn for a total-fledged “credit crunch” — a sudden and sharp slowdown in lending —capable of pushing the U.S. economy into economic downturn.

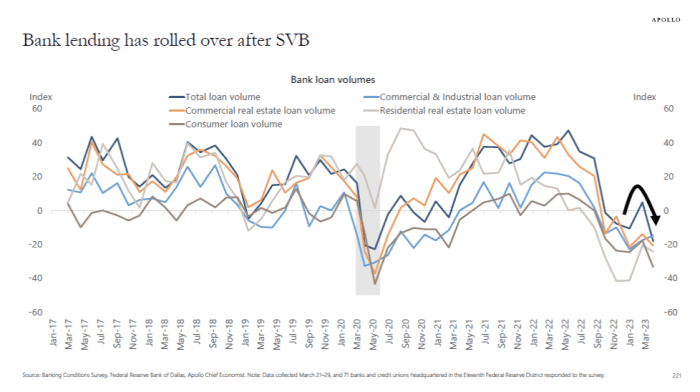

The squeeze is presently remaining felt, according to Torsten Slok, chief economist at Apollo World Management. He penned a Thursday notice, titled, “The credit score crunch has begun.”

Slok cited a study of 71 financial institutions in the Dallas Federal Reserve Lender district concluded March 21-29, immediately after the March 10 collapse of Silicon Valley Bank, which, he mentioned, “shows a dramatic reversal in financial loan volumes.” (See chart down below.)

Apollo World wide Administration

The Dallas Fed, in the monthly survey introduced Monday, claimed loan demand from customers declined for the fifth period of time in a row as bankers noted worsening company activity. Financial loan volumes fell, pushed mostly by a sharp contraction in client loans, the survey discovered.

“The macro impression of the failures of Silicon Valley Lender, Signature Bank and Credit Suisse moreover the downgrades of several regional banking companies has resulted in a disaster of confidence in our banking procedure,” a person study respondent claimed, according to the Dallas Fed.

A credit score crunch is not a foregone conclusion. St. Louis Federal Reserve Lender President James Bullard on Thursday was skeptical that a lending slowdown would idea the financial state into recession.

“Only about 20% of lending is heading by way of the banking system and only a fraction of the financial institutions are small or regional banking companies,” Bullard explained. ““I just really don’t believe it is significant enough by itself to deliver the U.S. financial system into recession.”

Bullard, speaking at an party in Arkansas, said he doubted there would be a pullback of lending by little and medium sized financial institutions because loan demand remains strong.

Slok last thirty day period modified his see on the overall economy. Following formerly warning of a “no-landing” circumstance in which a resilient economic climate would initially keep away from a economic downturn completely, forcing the Fed to double down on tighter monetary coverage, the veteran Wall Avenue economist referred to as for a “hard landing” in the wake of the collapse of Silicon Valley Bank.

Slok subsequently warned that SVB’s collapse was likely to have a far more damaging effect on the economic climate than some previous economical crises, like the 1994 individual bankruptcy of Orange County, California, the 1998 collapse of hedge-fund Lengthy Time period Capital Management, and past year’s U.K. gilt problems. That since the conduct of regional banking institutions was set to adjust right after SVB’s collapse, he reported.

“Most important, the expenditures of cash have elevated, and underwriting specifications have tightened,” Slok reported in a March 21 note.

When the U.S. inventory current market weathered the instant aftermath of the banking mess, with significant indexes scoring reliable month to month gains in March, Treasury yields have pulled again sharply and fed-resources futures traders now see Federal Reserve coverage makers offering a collection of rate cuts by year-close.

The past week has noticed the inventory market wobble in response to information presenting original symptoms a sizzling labor market is beginning to neat. Traders are weighing no matter if extended-awaited signs the Fed’s intense collection of charge increases about the past 12 months are starting to slow the overall economy is a good in that it will make it possible for policy makers to back again off on even more tightening, or a damaging in that it may possibly presage a sharper slowdown than formerly anticipated.

The S&P 500

SPX,

was on monitor for a .2% slide in a getaway-shortened 7 days. U.S. stock exchanges will be shut on Very good Friday. The Dow Jones Industrial Typical

DJIA,

was up .6% for the 7 days, when the Nasdaq Composite

COMP,

was headed for a 1.1% drop.

The latest instability in the U.S. banking program could make for a additional intense and lengthier recession, stated Ryan Sweet, main U.S. economist at Oxford Economics, in a Wednesday notice. The firm sees a economic downturn beginning in the 3rd quarter.

He argued that the financial fees of stress in the banking technique “won’t be fully felt for several months as banks tighten lending specifications and minimize the availability of credit to homes and businesses.”

Oxford Economics sees a unexpected tightening in lending benchmarks posing a peak drag of .7 share stage on gross domestic product progress afterwards this calendar year, he mentioned. The Fed’s Senior Mortgage Officer Belief Survey, set for launch in May well, “will support us ascertain the fallout from the the latest turmoil in the banking technique,” Sweet explained.

[ad_2]

Resource website link