[ad_1]

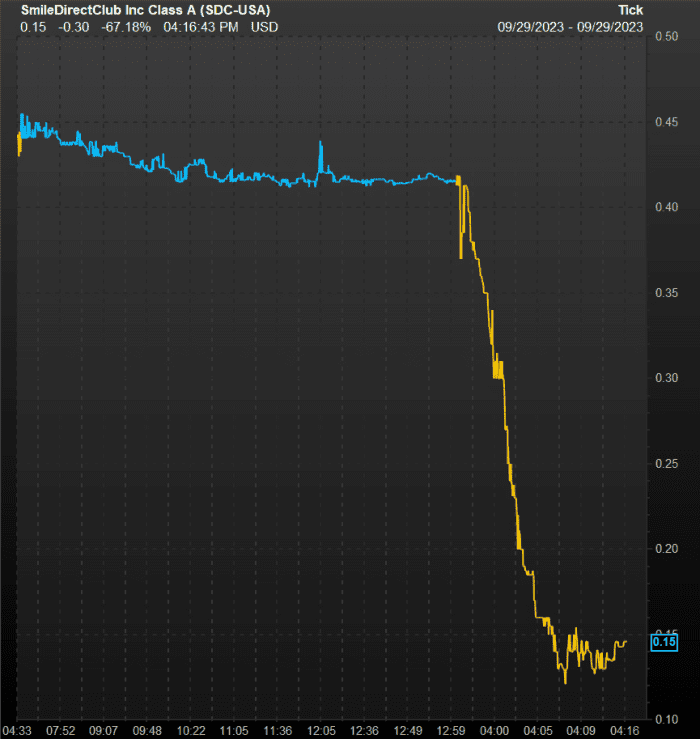

SmileDirectClub Inc. shares plummeted in the prolonged session Friday after the organization said it experienced voluntarily submitted for Chapter 11 bankruptcy safety as founders search for to recapitalize the enamel-straightening enterprise.

SmileDirectClub shares

SDC,

which experienced been halted while up .9% in right after-hrs buying and selling pending information, immediately dropped as a great deal as 85% when investing in the inventory reopened.

The inventory experienced shut Friday’s normal session down 6.6% at 42 cents a share, giving the organization a marketplace capitalization of just beneath $170 million.

In a assertion late Friday, SmileDirectClub said that its “founders have fully commited to make investments at minimum $20 million to bolster the company’s equilibrium sheet and to defend its in the vicinity of- and prolonged-time period money wellbeing,” and that “up to $60 million of additional cash is readily available on gratification of sure circumstances.”

SmileDirect shares in immediately after-several hours buying and selling Friday.

FactSet

“The founders’ financial investment in the company demonstrates their motivation to SmileDirectClub’s mission of democratizing access to quality oral care, as very well their conviction in the results of the not long ago launched SmileMaker Platform and CarePlus expansion initiatives,” the business explained.

“To effectuate the transaction, SmileDirectClub has voluntarily submitted for defense less than Chapter 11 of the U.S. Bankruptcy Code in the U.S. Personal bankruptcy Courtroom for the Southern District of Texas,” in accordance to the firm.

SmileDirectClub has experienced a rocky time of it due to the fact its public debut a very little above four decades ago, when the firm priced some 58.5 million shares at $23.

The stock never closed earlier mentioned $19.48, which happened a week soon after the IPO, and had traded at a record intraday significant of $21.10 through its post-IPO debut on the Nasdaq exchange, according to FactSet info.

[ad_2]

Supply backlink