[ad_1]

It has been 3 yrs considering that the U.S. stock marketplace strike its COVID-19 bottom as the world financial state out of the blue shut down at the start off of the pandemic in early 2020.

The S&P 500

SPX,

has risen practically 76% from its closing reduced of 2237.40 attained on March 23, 2020, although the Dow Jones Industrial Regular

DJIA,

is up 72.3% from its minimal of 18591.93 hit on the identical day and the Nasdaq Composite

COMP,

has highly developed about 70%, in accordance to Dow Jones Market Data.

Bacterial infections prompted by COVID-19 commenced to spread in early 2020, and stress brought on by the financial uncertainty led to a drop in the stock market that commenced in late February. On Feb. 24, the Dow industrial regular slumped much more than 1,000 details, its 3rd-worst day-to-day stage fall in historical past.

The selloff accelerated in mid-March, with the Dow entering bear-industry territory on March 10, down much more than 20% from the history near set in the earlier month. In the meantime, the big-cap index S&P 500 dropped approximately 34% in about a thirty day period, wiping out 3 years’ truly worth of gains for the market place, in accordance to Dow Jones Market Details.

Nevertheless, a large quantity of guidance from the Federal Reserve, including an unexpected emergency curiosity-level minimize, as very well as the speedy advancement of COVID-19 vaccines, limited a additional downturn in shares. The S&P 500 rose to an all-time higher in August and achieved quite a few much more all-time highs in the pursuing months, in accordance to Dow Jones Industry Data.

In 2021, a few major indexes all shut out the yr with strong gains as buyers brushed off a sequence of market place-transferring gatherings that could have crashed stocks. The sturdy effectiveness came in a 12 months described by, among other points, the January 6 attack on the U.S. Capitol, supply-chain disruptions, high inflation, labor-industry shortages and the omicron and delta COVID variants.

But as the calendar flipped to 2022, U.S. shares started off to tumble just after the Federal Reserve and central banking institutions close to the globe commenced increasing curiosity costs aggressively to struggle surging inflation, stoking fears of a global economic downturn.

Russia’s invasion of Ukraine in February 2022 and China’s zero-COVID procedures, in area until the region quickly scrapped the stringent steps in December 2022, also contributed to industry volatility. The three stock indexes all endured their worst 12 months considering the fact that 2008.

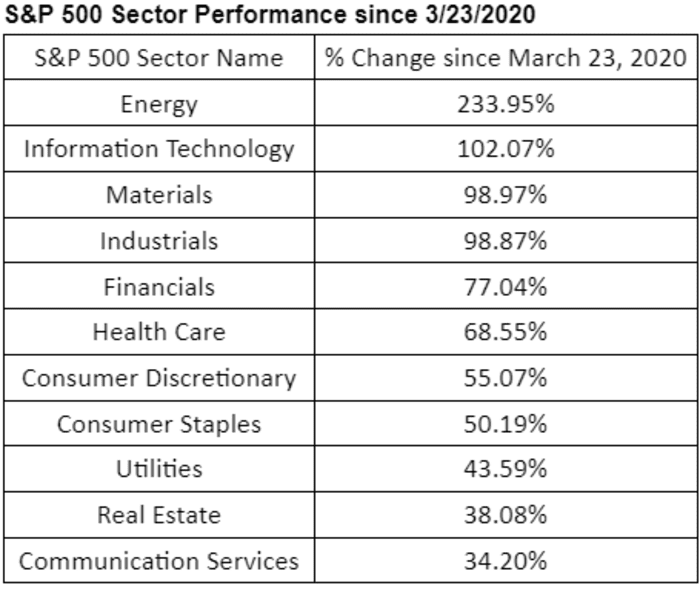

Among the 11 S&P 500 sectors, strength

SP500.10,

has been the finest-doing sector above the previous 3 years. The sector was boosted by a spike in crude-oil and purely natural-gasoline costs in the aftermath of Russia’s invasion of Ukraine.

DOW JONES Sector Information

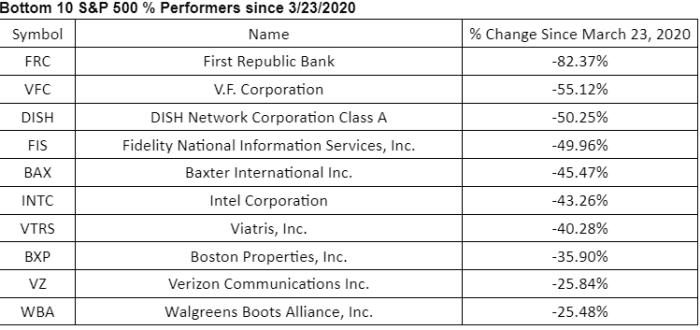

Amongst specific shares, Initial Republic Financial institution has been the worst performer in the S&P 500 because March 2020, with the financial institution coming beneath worry adhering to the collapse of two U.S. regional banks.

DOW JONES Industry Data

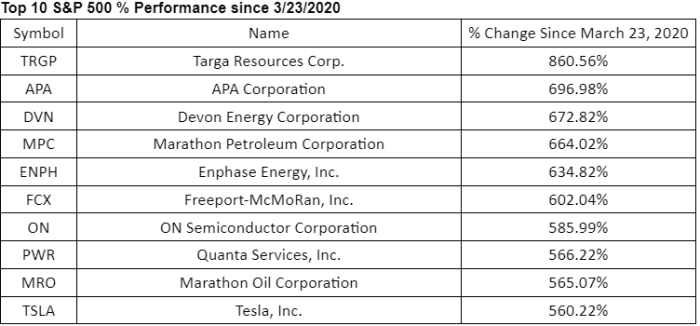

DOW JONES Market Data

Also see: The Fed pivot is in close proximity to, and yield curve inversion has very likely peaked. That is usually undesirable information for stocks, this Fidelity strategist states.

U.S. shares rallied on Thursday immediately after closing sharply lessen in the former session. The Federal Reserve lifted fascination charges by a further 25 basis points on Wednesday when noting that plan makers weren’t penciling in charge cuts this calendar year, irrespective of new anxiety in the banking business. Shares also reacted after Treasury Secretary Janet Yellen claimed she was not thinking of ways to assurance all financial institution deposits.

The S&P 500 obtained .3%, though the Dow innovative .2% and the Nasdaq Composite was up 1%.

[ad_2]

Supply link