[ad_1]

The strike by United Automobile Personnel towards the Significant 3 carmakers is sparking a broader be concerned amid stock-industry buyers about the outlook for company gains.

“If the strike expands, buyers can assume to see an affect on the wide financial system and strain on supply chains and corporate gain margins,” claimed Mark Hackett, chief of investment decision research at Nationwide, in a Friday be aware.

The UAW established up picket traces soon immediately after midnight, striking all three large automakers — Ford Motor Co.

F,

General Motors Co.

GM,

and Chrysler operator Stellantis NV

STLA,

— at the same time. Workers walked out of a Ford factory in Michigan, a Stellantis Jeep manufacturing unit in Ohio and GM pickup factory in Missouri, leaving scope for additional motion at other amenities.

Shares slumped Friday, with the S&P 500

SPX

down 1.1%, and turning fractionally lower for the 7 days. The Dow Jones Industrial Common

DJIA

declined about 275 details, or .8%, though the Nasdaq Composite

COMP

get rid of 1.6%.

Reside site: Huge 3 automakers dealing with targeted workplace actions

The UAW, which in the beginning known as for a 40% wage boost over four years, is now pushing for an enhance in the mid-30% vary. American Airways

AAL,

before this summertime agreed to a 40% raise for pilots over 4 a long time, whilst United Parcel Provider

UPS,

reached an settlement to boost pay back for unionized employees by 18% more than five yrs. And a strike by movie and television writers proceeds.

Labor strife arrives amid ongoing tightness in the work marketplace, which has proved amazingly resilient in the facial area of aggressive Federal Reserve price hikes.

“Whether it is Hollywood or airways, pilots, flight attendants, there’s a lot of labor stuff likely on appropriate now. That can only be a headwind to margins,” Hackett instructed MarketWatch earlier this thirty day period.

It speaks to a continued increase in real wages that could not be thoroughly appreciated, he said, arguing that consensus anticipations for 12% earnings growth in 2024 could demonstrate extremely optimistic.

There is also the danger of a broader disruption to the overall economy.

Around 13,000 of the UAW’s 146,000 associates are on strike at the a few vegetation specific so significantly.

“The impact on general GDP really should be constrained but, if creation backlogs create new supply shortages, then strikes could drive rates better,” said Paul Ashworth, main North America economist at Funds Economics, in a Friday observe.

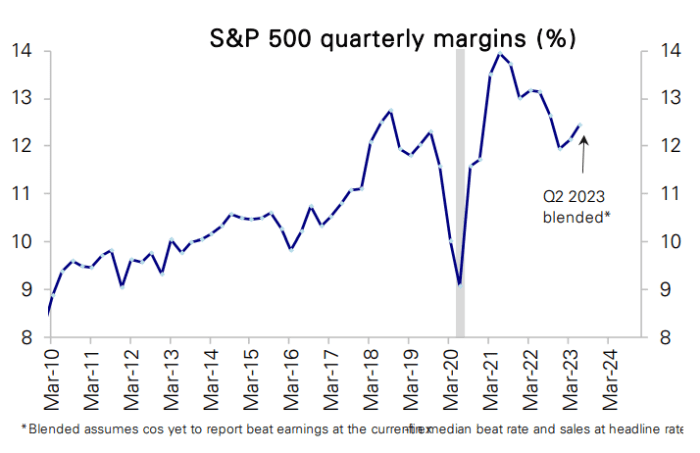

Company margins peaked two yrs back in the 2nd quarter of 2021 as inflation commenced to accelerate, pointed out a team of strategists led by Binky Chadha at Deutsche Bank, in a Thursday be aware. They then fell for 6 consecutive quarters as the pandemic increase reversed (see chart beneath).

Deutsche Bank

Margins bottomed in the ultimate quarter of previous 12 months and have rebounded in excess of the earlier two quarters as authentic progress recovered, they observed.

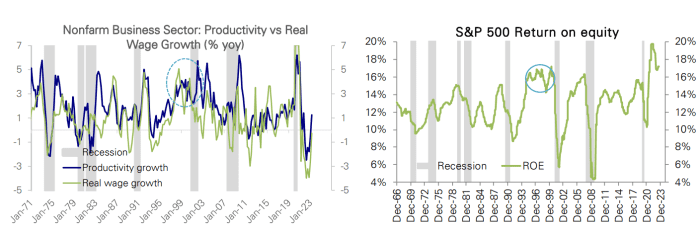

The Deutsche Bank strategists, in the meantime, argued that tight labor markets seem to be a prerequisite for productivity expansion.

“It is extensively thought that expansion are not able to select up without the need of increasing future inflation. But limited labor markets have traditionally been a precursor to quick productiveness progress phases as it incentivizes organizations to adopt new technologies,” they wrote.

Deutsche Lender

In that vein, early estimates are for artificial intelligence to push a efficiency increase, the strategists explained, with timing unsure and magnitudes equivalent to that observed from the 1990s efficiency increase usually attributed to expense in tech. That led to notable expansion in true wages and returns on expense in the late 1990s (see chart earlier mentioned).

[ad_2]

Supply backlink